First and foremost, let’s clarify: this is not the 2025 outlook. It’s our periodic market and macro insights from the argan.ai factory with NINA our chief AI Strategist, likely the last of this year. The first on LinkedIn! Why insist on the distinction? Because the truth is, no one really knows what 2025 holds, and most glossy annual outlooks are often more about showcasing expertise than genuine foresight. History proves that relying on those expert predictions can leave you worse off than just sticking with the index.

DAte

Dec 13, 2024

Branding

Reading Time

8 Min

Lets then also admit my own aim here to offer value and….to signal competence —Any difference then? Our strategy is directly invested, its performance transparent, and we refrain from making hollow predictions gazillion years into the future. Rather my goal here is to tell you what we look at when we make informed decisions based on our agentic system NINA for our own fund, and the things you might want to look at as well. The signals we look at have been validated by NINA.

TL:DR

While I am happy that NINA’s strategy closed November with a solid 7.4% gain, the reality is that while the returns feel good, the macro backdrop casts a more complicated shadow. In fact a lot of our signals are flashing bright red. Markets and fundamentals can dance out of sync for ages, which is why we weigh both hard data and behavioural quirks, staying firmly in the game while managing the ever-present risks.

Today’s landscape is one of intriguing contradiction: strong growth, stable housing, resilient labour, and yet uncomfortably persistent inflation lurking just close enough to matter. Credit spreads at their lows won’t stay low forever. If inflation heats up, inflation risk premia reprice, policymakers may tighten, and suddenly the once-invincible market run could face turbulence. Moreover the fiscal put has replaced the FED put, which is a more tricky road to want to manoeuvre, and how much of that put has already been priced in? Or how do we balance the effect of immigration policies and tariffs? NINA, our AI chief strategist has a simple approach: keep a foot on the accelerator, but hover the other over the brake. The point is not to know the future, but to stay adaptable in the present. So what do we look at now?

1. Inflation is key these last weeks…

…and beyond. As stated before, the US economic sea seems 𝐝𝐞𝐜𝐞𝐩𝐭𝐢𝐯𝐞𝐥𝐲 𝐜𝐚𝐥𝐦. U.S. growth has surpassed conservative forecasts, and near-historic low jobless claims signal a resilient labour market. Strong housing sentiment underpins the broader macro narrative. Despite distortions from hurricanes and strikes, doomsday bettors may need to wait a bit longer.

Yet, the lurking wildcard remains 𝐢𝐧𝐟𝐥𝐚𝐭𝐢𝐨𝐧. Core PCE deflator at 2.8% year-over-year, balancing on the edge between stable and simmering. Even with the fiscal put in place next year, if inflation increases again, assuming the FED remains independent, there will be little room for further support. It is going to be very hard to keep the bond market satisfied then and there is a real chance the fiscal put will be void. Equities, Housing, and risk takers in general will bear the brunt.

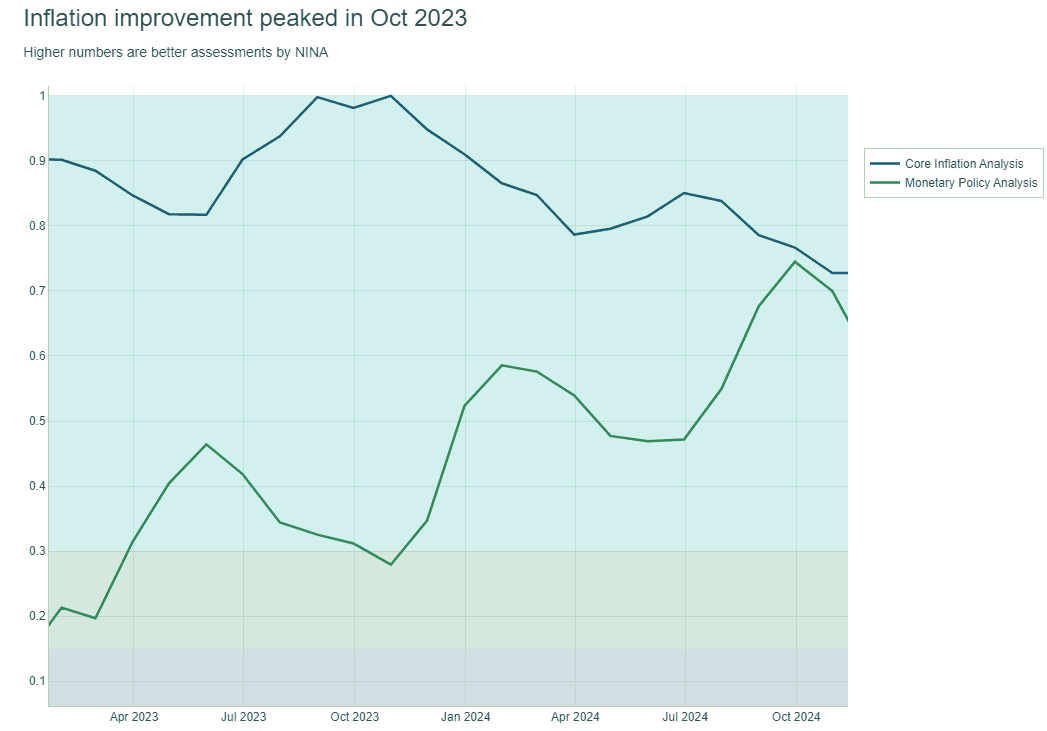

The graph below shows the aggregate analysis scores of NINA for core inflation and monetary policy. Notably, the inflation trajectory peaked in October 2023 and has been declining since. The monetary policy score looks to also start to peak around this stage.

Last week we got labour data, so that’s out of the way and gave no strong reason not to cut yet. Wednesday we saw a stubborn core CPI at 3.3%, mostly due to shelter which went up by 4.7% YoY in November (less than the 4.9 %YoY reading of October), and we had the PPI print that suggest the Core PCE Deflator might come in at an increase of +0.15% to +0.25% for Nov, which is a good thing as it is below expectations. At the same time it still signals inflation persistence, as any path towards normal would have to be a very slow one with these numbers.

The core PCE release is critical for the December FED meeting, and it seems that a 25bps cut is pretty much going to happen. The commentary and guidance however will be important. The inflation path will be key for 𝐛𝐨𝐧𝐝 𝐦𝐚𝐫𝐤𝐞𝐭 𝐬𝐭𝐚𝐛𝐢𝐥𝐢𝐭𝐲 in 2025 under the new administration. And bond market stability will be key to equity market multiple expansion and with a lag even earnings growth.

So?

2. Monetary policy: walking the tightrope

Federal Reserve Chair Jerome Powell's cautious stance reflects a delicate balancing act. While supporting economic growth, the Fed remains vigilant against inflationary pressures. Powell's indication of a slowing in the pace of rate cuts or one can interpret it as maybe adopting a one-cut-every-other-meeting approach shows the uncertainty around the expected impact of Fiscal policies ahead. While the market has made up its mind on the fiscal put, the FED has not.

Federal Reserve officials exhibit diverse views, adding complexity to the monetary policy outlook. For instance, Waller with a hawkish reputation has expressed a dovish bias, while Kugler expresses concerns about supply shocks and immigration policy impacts and Musalem suggests considering slowing rate reductions. This internal diversity within the Fed underscores the nuanced approach required in monetary policy.

Strong forward GDP projections (around 3.0% for Q4) confirm that growth has more puff in the sails than many expected. This helps explain why markets have tolerated the idea of less aggressive rate cuts. Solid economic footing encourages policymakers to slow down, not rush.

At the same time, persistent inflation and the specter of supply-side shocks—from tariffs to immigration restrictions—could destabilize expectations. Inflation’s tyranny is subtle: if it creeps upward, equity valuations face a re-evaluation, and credit spreads could finally widen. None of this happens in a vacuum. These crosscurrents represent real forces, pushing and pulling asset prices.

We must also consider that a “fiscal put”—the expectation of government stimulus—might be already baked into current valuations. But what if that put isn’t as bottomless as hoped? Heavy deficits and a watchful Fed might leave less policy firepower in reserve than investors assume, setting the stage for sudden shifts in sentiment down the line.

3. US-EZ Divergence

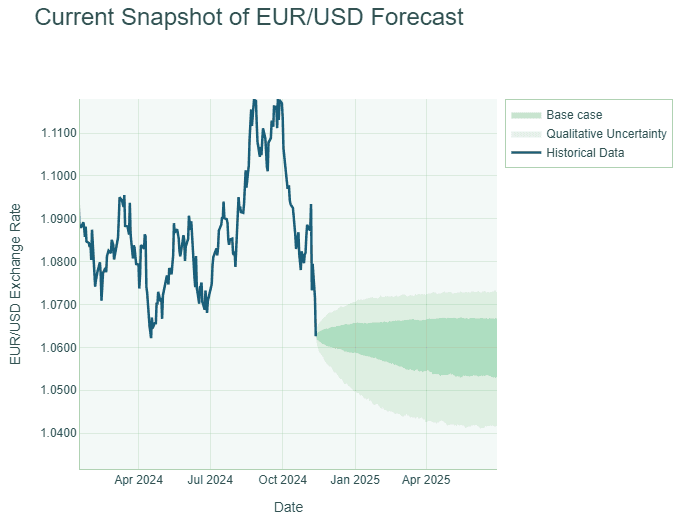

Between the Eurozone and the US, policy divergence is emerging. The Eurozone can be expected to maintain a lower rate environment compared to the US, influenced by differing economic recoveries and policy responses. This divergence is reflected in the yield curve movements and global trade dynamics. And in turn this will keep pressure in the EURUSD currency dynamics, in favour of the US Dollar.

As shared in our report: https://ciodesk.argan.ai/p/america-first-20-return-of-the-fiscal, the strong dollar can exert downward pressure on growth. Looking at the S&P500 companies, more than 40% of aggregate earnings come from non-dollar buyers. We have seen this in 2022, a strong dollar can weigh on earnings. On the other hand, a robust dollar places downward pressure on dollar-denominated commodities, impacting industries tied to raw materials, which in turn somewhat dampens exogenous inflation pressures. Note the word exogenous.

For our Argan Agentic Strategy, this is a double-edged sword. A strengthening dollar boosts portfolio returns from our U.S. holdings, but it negatively affects some of those same portfolio companies' earnings. Our previous estimate for the Euro to remain between the 1.05 and 1.09 levels on the medium-term, remains largely true. It has come down slightly towards the 1.04-1.08 range. For a broader set of outcomes, see the graph from our previous report below.

4. Credit Market Volatility: The Calm Before the Storm?

Credit markets, meanwhile, remain in their blissful honeymoon phase, with spreads hugging historic lows. But honeymoons end. If inflation risk premia reprice and growth expectations adjust, credit could lose its cool. Credit spreads at these levels do signal complacency in the bond market.

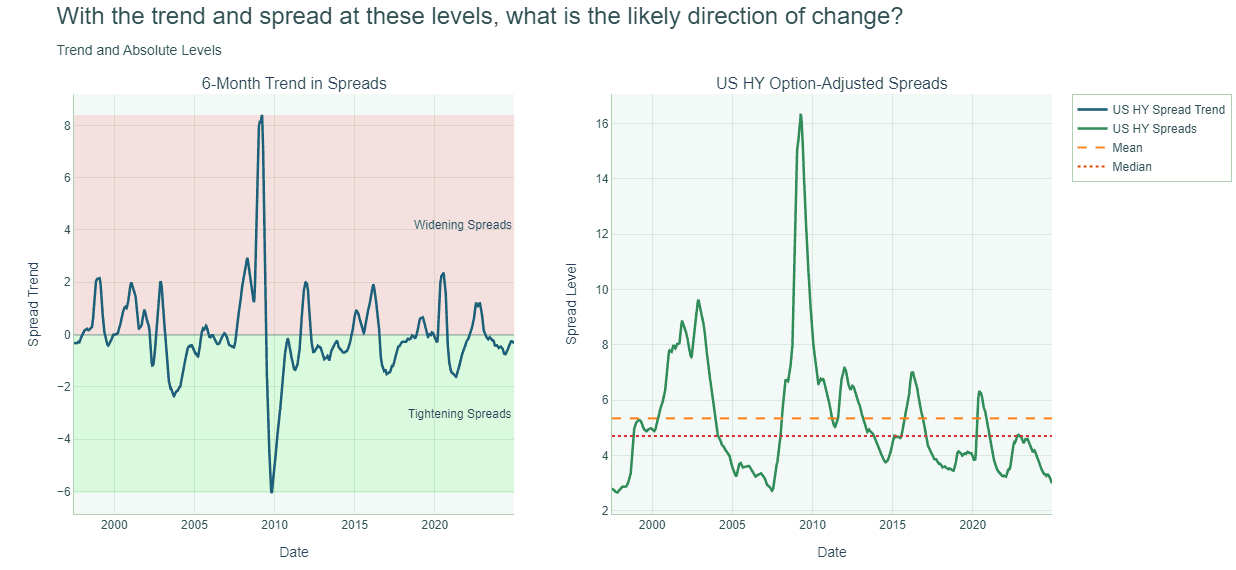

In the graph below we show the cyclical nature of the trend in credit spreads. A trend from which we are coming out of an almost 2 year sliding down downwards towards historically low levels. For NINA, this is a key data point to watch. The trend has already reversed slightly. The fundamental agents of NINA that are built to interpret this through the lens of theory, point to risk we mentioned previously. Any uptick in inflation or economic uncertainty could accelerate the trend reversal significantly, leading to increased volatility. While being short vol has paid off, will it continue to pay off in the future. Here is our philosophy like broken record: rather than predict the path, adjust to it.

The Final Word: Embrace the Contradiction

We stand at an intersection of strong growth and stubborn inflation, of market optimism meeting policy caution, and of expected fiscal stimulus priced in by the market. Given as an example: credit spreads can’t compress forever, and eventually, something’s got to give. Our stance is unapologetically realistic: remain engaged in the market, but acknowledge the crosscurrents and be ready to pivot. Looking at our returns of 7.4% in November, you might think that NINA is extremely positive. The truth is that the quant score of the system is almost 4 times lower than the beginning of 2024 and the outlook is not all that great.

Still, this narrative isn’t about predicting some far-off future. It’s about understanding today’s dynamics and staying agile. By focusing on for example: inflation, monitoring credit spreads, dollar strength and keeping an ear to policy signals, we stay prepared for whatever comes next. In this environment, that’s as good as it gets. An older and Weisser CIO I worked with, and learned a lot from, told me look at investors portfolio rather than their story to understand what their view is on the market.

So here is where we stand, we have a small portfolio of companies, less than 2% of the MSCI World, with roughly similar regional exposure. These are biased towards quality, deemed by NINA to be in secular long term trends, and are deemed by NINA to be able to withstand both headwinds in real yields as well as economic slowdowns in terms of their earnings growth. On top of that we have synthetic exposure to technology, and a hedging risk system able to step in when multiple expansions are threatened (this happens before EPS growth is hurt). We add gold and other hedging assets from time to time to safeguard the portfolio and add orthogonality when our gold analyst agents see the right signals, which is unfolding again. That’s it.

Look we do have estimates of what various equity markets can be expected to do, for example we expect roughly another 10% until mid year in the SPX index, based on an EPS growth of 6% and multiple expansion of roughly 3%. But really if in Jan we learn that inflation risk premia are under-priced, as is very possible, these numbers are changed, so look at the signals don’t bet on the 2025 annual outlook. This is not a 2025 annual outlook.

argan.ai: Your Partner in Navigating Complexity

This was an in-depth macro analysis, based on the macro intelligence engine of NINA (Novel Network of Investment Agents), the Agentic system we made at argan.ai. The goal is to provide you both with market insights, as well as insights from an allocator perspective. Like how do we look at private credit allocation with the spread levels? Or examples of benchmark engineering I have seen as a family office executives.

Starting May of this year, the strategy derived from NINA for the Argan Agentic Fund went live and has returned ~32% (Until Nov). Our older system, prior to NINA, has a model portfolio going back to 2021. Including its performance would put the YTD results at 37.6% until Nov 2024, with a long-term annualized vol of 10.4%.

At Argan.ai, our philosophy is straightforward: we put our money where our insights are. We're not just observers; we're participants in the markets we analyse.

Feel free subscribe to this newsletter for future insights or to reach out to me at Reza@argan.ai for any info on the Argan Agentic Fund or other enquiries.

Legal Disclaimer

This communication is provided by Argan Technologies B.V. concerning the Argan Agentic Fund ("Fund"), an alternative investment fund under the Dutch Financial Supervision Act (Wft). The Manager is exempt from obtaining an AIFMD license and is not supervised by the Netherlands Authority for the Financial Markets (AFM) or the Dutch Central Bank (DNB).

The information herein is for informational purposes only and does not constitute an offer to sell or a solicitation to buy any securities or investment products. Investing in the Fund involves significant risks; past performance is not indicative of future results. Potential investors should read the Information Memorandum (IM) and consult their legal, financial, tax, and other advisors before making any investment decisions.

The Manager and its affiliates disclaim any liability for loss arising from reliance on this information. This communication is intended for residents of the Netherlands and is governed by Dutch law.

Originally Published On: https://www.linkedin.com/pulse/2025-outlook-reza-kahali-uzbde/