Throughout my time working with top strategists and hedge fund managers worldwide, I’ve distilled an investment process and philosophy designed to protect and grow capital over the long term. The essence of that philosophy now lives in our AI-powered chief strategist, NINA, with which we run our fund.

DAte

Jan 20, 2025

Branding

Reading Time

12 Min

Since mid-December 2024, NINA’s macro intelligence engine has become cautious. In this newsletter, we’ll unpack the “why” behind that caution and shed light on the key market, data, and policy dynamics to watch.

NINA’s hybrid strategy

NINA’s strategy isn’t just about picking stocks and calling it a day; it’s a three-pronged approach:

Equity Intelligence Engine Target a concentrated core portfolio of companies that generate significant profits, hold dominant positions in industries with secular tailwinds, and can weather economic storms.

Macro Intelligence Engine Recognize that the broader economy and market behaviours aren’t just wallpaper. We protect our investments during downturns, look for cross-asset dislocations to profit even in tough times, and ride tailwinds when the economic, market, and policy signals flash green.

Risk Intelligence Engine Sometimes, market conditions turn too risky—no matter how solid the fundamentals look. When our indicators flash red, we dial back. This pure market-condition-driven approach helps us avoid catastrophic drawdowns.

The bearish tone comes primarily from Part 2—the Macro Intelligence Engine. It’s been flagging red for a while. That warning hinges on an interplay among three major factors:

Incoming Economic Data—How growth, labour, inflation, and uncertainty are evolving as policy actions by corporations, market participants, the government, and the Fed take hold.

Policy from the New Administration—Currently reflected in the pricing of uncertainty in bond and fixed-income option markets, plus volatility across risk assets.

Federal Reserve’s Expected Policy—How the Fed’s independence might be tested by the new administration, and how that influences future rate decisions.

Recent economic data: what we’ve seen

We’ve had two important weeks for labour and inflation data, so let’s talk highlights:

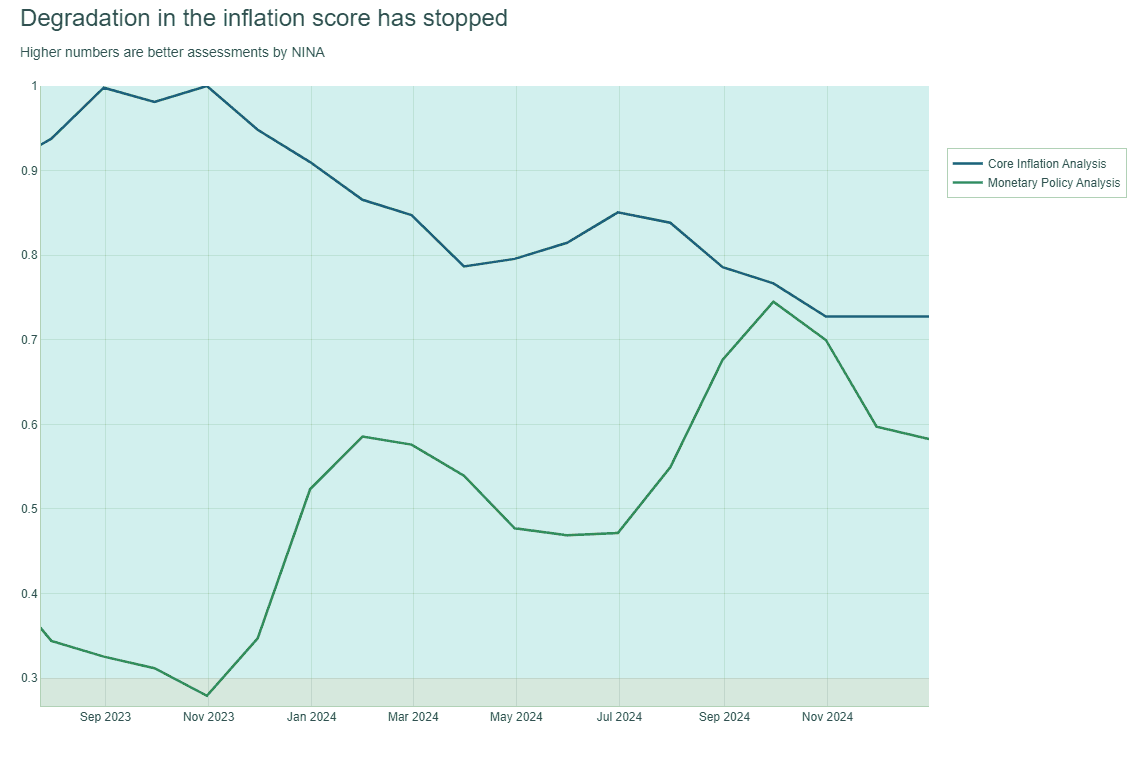

Inflation Surprise: Last week, core CPI came in at +0.2% MoM, softer than expected. Looking at the conclusions from our system the deterioration in the inflation score has plateaued for now which is a good thing. Well discuss how these are built up in another note. For now it suffices to say that the outlook has improved.

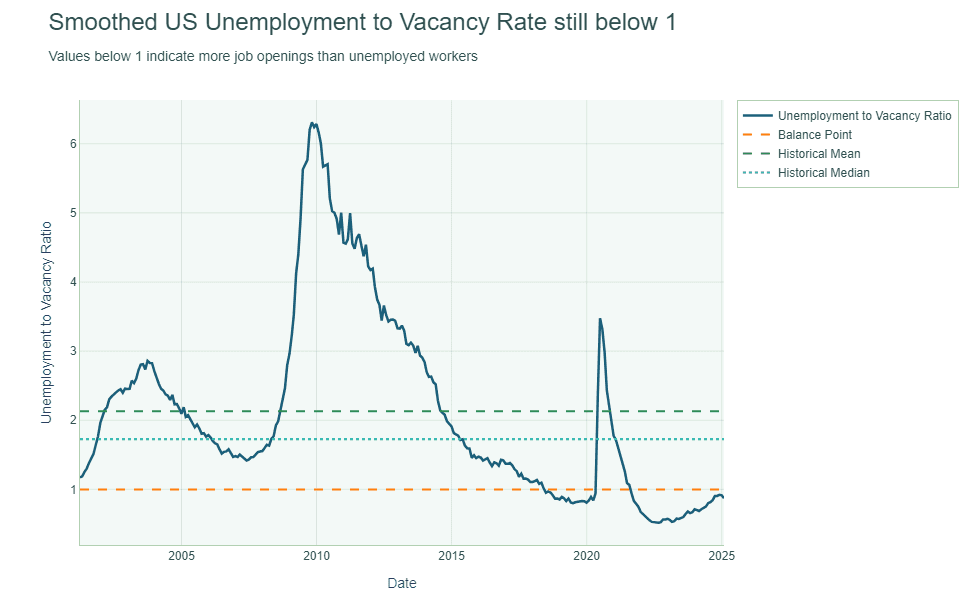

Labour Market: As said before, markets are sometimes quick to forget that the labour data from the prior week looked hotter than expected, even accounting for fading distortions from floods and other exogenous factors. A key relationship I would like to address is the Labour market data two weeks ago versus the Inflation reports we saw this week. The labour market remains tight and NINA identified unemployment-to-vacancy ratio as a key indicator of tightness in its simulations. Just simple extrapolation suggests, the labour market is still too tight for us to celebrate the progress on inflation.

With the mean and median throughout history significantly higher than the current rate, we might want to look for this number going >1%. So how does this data trickle down in markets, while we have seen equity market volatility I’d like to place more emphasis on signs from the bond markets.

Market reaction: focus on the 10-year yield

10-year US bond yields went from ~3.6% to ~4.6% in about 4 months—and have even reached >4.8%. Why though? And why does it matter?

Nominal yields tell the world how much lenders (bond investors) want to be compensated for their loans. My favourite way of dissecting this into its components is:

Growth expectations: If economic growth picks up, you could earn more by investing your dollars elsewhere. So you’ll demand a higher yield on your loan to compensate. This is the real rate component, observed by the yield on TIPS (Treasury Inflation-Protected Securities).

Inflation expectations: If inflation rises, your future dollars buy less. So again, you want higher yields to preserve purchasing power. This is the break-even inflation component – Measured by subtracting the observed TIPS yield from nominal yields.

Term Premium: The longer the term (say 10 years), the more uncertain you are about both growth and inflation. You’ll want extra compensation for that uncertainty— it is estimated rather than observed.

Real rate + break-even inflation rate = nominal rate. Also: the expected short term rate + term premium = nominal rate. Both real rates and break-even inflation include short-term expectations and a term premium component. The term premium can shoot higher when markets fear unknowns—like policy shifts from a new administration, or how the Federal Reserve might respond to surprising economic data.

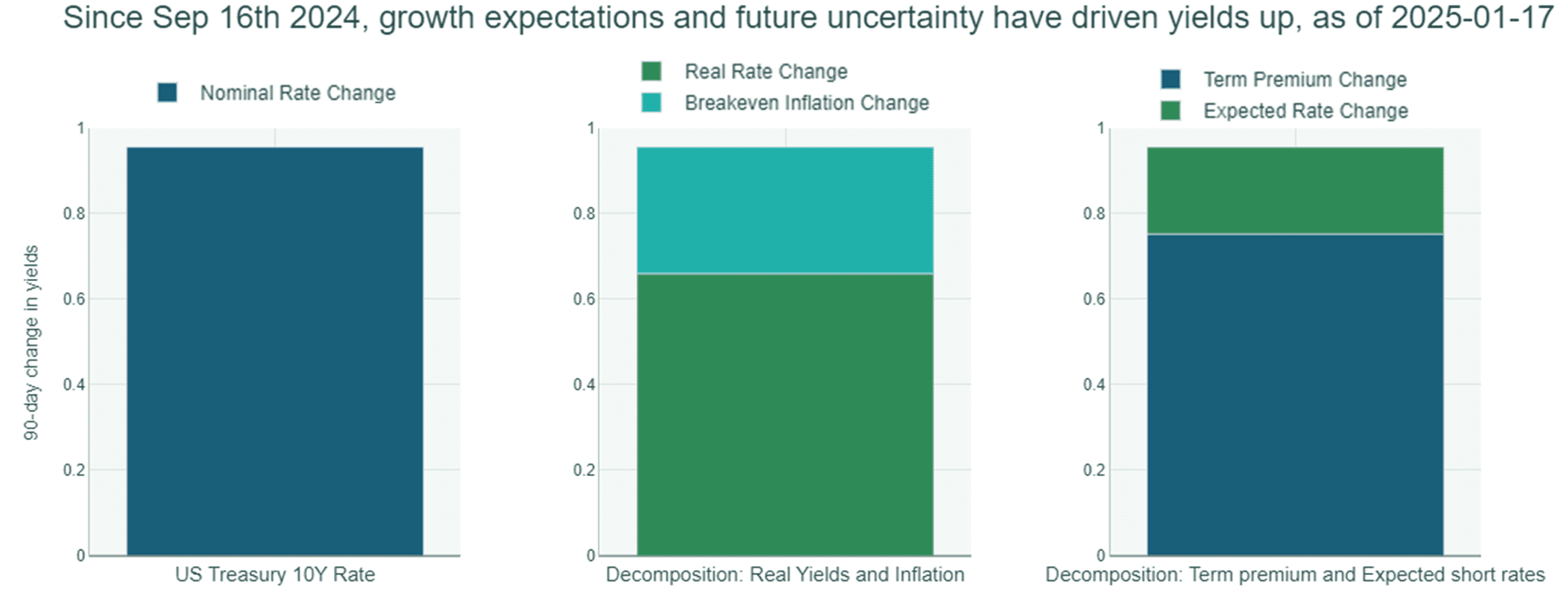

Then what does the data say? Below you see the change in yields since Sep 16th 2024, right before the 50 bps cut. This has then been decomposed both into its real yield (growth) + inflation components and its short term rates + term-premium (uncertainty about the future) components.

Of the ~1% surge in US 10-year yields >65%! came from improved growth expectations, while <35% stemmed from inflation worries. Moreover, over 75%! of the surge is due to uncertainty around the path of both growth and inflation—think new administration policies, fiscal spending, and how the Fed might react to policy effects and economic data.

(As I noted last week: Don’t spook term premia—while high real yields are restrictive in themselves, adding uncertainty makes it worse.)

So yes, inflation data might have come in “better,” but real yields can be restrictive, and uncertainty about the path and effect of (fiscal/monetary) policy can hurt. Silver lining? There is a lot room for term premia to shrink as we lean more.

You don't buy bonds? Rising (real) yields, term premia, yield volatility, etc. matter for anything from equity valuations, medium term earnings potential, currencies, gold, housing etc. And too much or too little of either growth or inflation is disliked by the market. Equity markets remain sensitive to the US-10 year yield. Key levels to watch for are >4.8% and >5% for a deeper correction. Note also that this suggests, until we see significant weakening in data, a continued positive relationship between bonds and equities, and bad news for the 60/40 portfolio.

Again its the interplay between, government policy, monetary policy and economic/market behavioural impacts that determines inflation and growth expectations and the term premium around these. It is this interplay why sometimes good news is interpreted as bad news, and bad news as good news.

Say PMI’s come in much higher than expected (as they did)? Good news, expansion of businesses are suggested. But wait this means that the bond markets react with higher real yields, the fed is expected then to keep short term rate restrictive, the dollar remains strong and we still expect the new administration to throw more fuel on the fire. Bad news.

The old adage: too much of anything is too much. Too much strength and too much weakness are bad. In between is where you want to be.

Fed vs. Market: who’s right on the neutral rate (r*)?

A key point of contention between the Federal Reserve and market participants involves the “neutral rate” (r*). This is the policy interest rate that neither stimulates nor restrains economic growth.

Fed’s Star Variables: The Federal Reserve customarily updates its “star variables,” including r*, at a measured pace. Recent Fed minutes show that officials are wary of persistent inflation risks, and they stress the importance of assessing data over time before implementing further rate changes. Some members remain open to rate cuts if inflation pressures subside, yet others express concerns that inflation could remain elevated.

Quantitative Tightening (QT): There was no indication in the minutes of scaling back quantitative tightening, implying the balance sheet runoff will proceed for the time being.

Divergent Views: We’ve had dovish chatter from folks like Governor Waller, but NINA’s macro engine (which parses all these speeches) suggests that deep disagreements remain among Fed voting members.

Diverging Policy: U.S. vs. Eurozone: While the U.S. debates what to do about a strong labour market and potential inflation, the Eurozone is slowing. Current expectations put the Eurozone deposit rate heading below 2%. Coupled with pro-business U.S. fiscal policies (and, ironically, some new Trump tariffs that could slow Europe further), the EUR could weaken towards, or below, parity with the USD. That’s something euro-based investors—and people like us—can’t ignore.

The new administration: Trump’s second term agenda

Today, president Donald Trump’s returns to the White House— (https://substack.com/home/post/p-151546941)— brings a renewed focus on pro-business policies. Yet on the flipside, secondary effects of all that stimulus, the stronger dollar and the Administration’s push for stiffer immigration controls and new tariffs could increase uncertainty, decrease us company earnings, scare off bond investors and undermine economic growth. How effectively the new Administration sustains overall market confidence may hinge on carefully pacing its more sensitive policies—particularly tariffs and immigration measures. Here’s what to watch:

Tax and Regulatory Policies

Deregulation: Expect swift rollbacks on environmental and financial regulations from the Biden era, plus room for new AI- and crypto-friendly rules. We can expect to see executive orders coming in from day one.

TikTok ban: Trump can be expected to be look for fast solutions. As we have seen he is using the extension to negotiate with the parent company ByteDance. For Beijing this is leverage, but if things don't work out we know from his previous term that Trump and his team will be the last to take blame.

Tax Relief: The 2017 tax cuts mostly remain. New cuts could happen, but deficits are already sky-high, which may limit how far they’ll go.

Key Appointments: Special attention should be placed on seeing which new heads will be appointed at key regulatory agencies. Hegseth seems a sure thing to go and run the Pentagon. Other important names are Rubio (foreign negotiation expectations), Bessent (fiscal path forward), Bergum and Wright (drill-baby-drill).

Trade and Immigration

Tariffs and Trade Tensions: Tariffs will make a comeback, spreading beyond China to cover imports from Canada, Mexico, and certain European nations. Given the low level of flexibility in their fiscal policy to fight off the recent weakness Germany is a prime target for example. We can expect to start seeing the negotiation timelines quickly. A targeted import tariff of double the current gross number or more can be expected.

China Tensions: Beijing remains a strategic competitor but also a necessary partner on hotspots like Russia and Iran. China’s real GDP growth just clocked +5.4% (4Q24), demonstrating the efficacy of their recent policy and readiness to brace for more tariffs. Look for a 15 bps cut by the PBoC and targeting a stable CNYUSD around 7.2 as China prepares to fight fire with more investment and infrastructure spending. Moreover, Beijing will concentrate more towards exports to EM countries to be less at risk from the upcoming tariffs. Their readiness to face the new administrations tells us that they are ready to keep the CNYUSD firm, which in turn means that the US consumer is poised to feel pain from the tariffs from the higher import prices.

Immigration Restrictions: Trump 2.0 is seen as tightening the border more rapidly than his first term, which may stifle a major driver of economic growth. This potentially drags down GDP growth, even if some of the stricter policies have already surfaced during Biden’s closing months in office.

Rising Deficits and Global Flashpoints

Deficit Concerns: Tax cuts + high spending + no interest in entitlement reform = ballooning deficits. This can push term premia higher and choke economic momentum. There are some key unknowns here such as the budget reconciliation, tax-cuts, spending cuts from DOGE (is there room for all that much spending cuts?) and the debt ceiling as was warned by Yellen.

Impoundment: Trump could again withhold or redirect already-approved spending (as he did with Ukraine funds). This remains a strategy the president can utilize to block spending while his team fight the courts.

Settling Global Conflicts: The Administration wants to put an end to “forever wars” by engineering compromises with multiple actors in Ukraine and the Middle East. Yet deep disagreements on territory, security, and alliances suggest that even the best-case scenarios look like fragile truces. Tensions with Iran, Russia, and other players could flare up again, underscoring the challenge of navigating these crises without rattling markets.

Still there is some evidence that the Trump Administration is aware the the market is watching with a slight case of the jitters, and we can expect them to implement policy gradual and with precision. On the other hand, on social media, President Trump has floated ideas such as purchasing Greenland, renegotiating trade deals with Canada, re-establishing greater U.S. influence over the Panama Canal to “protect American interests” and so on. Though as we have learnt throughout his first term these are often strategic and aimed bolster his negotiation position, they can add to uncertainty and risk scaring bond investors over term premia.

Fed tension under the new administration

One of the most notable changes is Vice-Chair for Supervision Michael Barr’s resignation from that leadership role, though he remains on the Board of Governors:

Vacant Leadership: The White House can install someone more aligned with pro-deregulation.

Moderating Influence: Barr is still on the Board, meaning the Fed won’t pivot to looser bank oversight overnight. Having someone who has championed balanced regulation could slow the Administration’s push for rapid deregulation.

Potential Tensions: The White House wants aggressive deregulation. The Fed’s independence might not budge so fast. Any public disagreements could heighten investor concerns about policy uncertainty, independence or erratic financial oversight. Again this could bruise term premia and option market volatility.

Meanwhile, Chair Powell’s term ends in 2026. If tensions boil over, the Administration could replace Powell (or others) with more sympathetic voices, intensifying concerns about Fed independence—and markets don't like meddling with the central bank.

Putting it all together

NINA’s Equity and Risk Intelligence Engines may be stable, but the Macro Intelligence Engine has been bearish—even though it’s improved since last week. Here’s the quick-and-dirty summary of why and what we have discussed in this article:

Uncertainty Over Growth & Inflation: Uncertainty around the path of growth, labour, inflation and the balancing act of monetary vs fiscal policy has increased. Resulting in higher term premia, and higher expected implied vol environment. There’s a legit reason for higher term premiums, given U.S.–China tension, the tight labour market, and an unpredictable administration.

Watching the 10-Year: Keep an eye on US 10-year yields at 4.8% and 5%. Above those levels, equity markets could take a bigger hit.

We are still not a fan of bonds: We do not believe they will never be attractive, but just not now. Gold remains interesting given the dynamics of the government balance sheets, strategic buying of central bank, and in turn when real yields falter.

The 60/40 portfolio cant catch a break: That also means that until we see significant weakening in data, a continued positive correlation between bonds and equities can be expected, which is bad news for the 60/40 portfolio.

Labour Market vs. Inflation: Given the current labour market tightness, and the upcoming immigration policies we keep a close eye on the unemployment-to-vacancy ratio and we do not want to see it go further down <1% but wed like to see it go up ≥ 1% (not too much though). We believe this matters for FED policy and the neutral rate.

US Dollar Strength: The strong dollar is good news for inflation, bad news for earnings, bad news for euro investors in us companies.

US oil supremacy: we can expect a continuation of US independence and high output when it comes to oil.

Central Bank Divergences: Europe is weaker; With the central bank divergences of Europe and US and the stance of Trump vs Europe we can expect significant USDEUR strengthening, moving towards or beyond parity.

Beijing's Preparation: We can expect further stimulus, the next real GDP target to be >4.5%, and efforts to keep from significant weakening CNYUSD (≥ 7.2)

With major unknowns around how growth, labour, and fiscal/monetary policy interplay, the market is (so far) unconvinced everything will balance out smoothly. Over time, as policies solidify, we may see a repricing of uncertainty—just like 2017. But until then, it could be a roller coaster.

NINA’s Performance and Next Steps

All of this isn’t just theoretical. Our argan.ai flagship strategy, which runs on NINA, returned +2.91% (EUR) in December 2024 and +28% (EUR) since going live in May, and 45% in 2024 if we include the older model’s paper portfolio.

Yes, the market landscape is complicated. But as we keep a keen eye on growth, inflation, labour dynamics, and that delicate dance between the Fed and the White House, we’ll find the sweet spot—or at least protect ourselves from the worst drops.

If you’re curious about signals, research, or more on the strategy, feel free to reach out. Stay tuned for more insights, and remember: in a world of swirling headlines, clarity is often your best investment edge.

Legal Disclaimer

This communication is provided by Argan Technologies B.V. concerning the Argan Agentic Fund ("Fund"), an alternative investment fund under the Dutch Financial Supervision Act (Wft). The Manager is exempt from obtaining an AIFMD license and is not supervised by the Netherlands Authority for the Financial Markets (AFM) or the Dutch Central Bank (DNB).

The information herein is for informational purposes only and does not constitute an offer to sell or a solicitation to buy any securities or investment products. Investing in the Fund involves significant risks; past performance is not indicative of future results. Potential investors should read the Information Memorandum (IM) and consult their legal, financial, tax, and other advisors before making any investment decisions.

The Manager and its affiliates disclaim any liability for loss arising from reliance on this information. This communication is intended for residents of the Netherlands and is governed by Dutch law.

Originally Published On: https://www.linkedin.com/pulse/markets-guideline-time-uncertainty-reza-kahali-aozae/?trackingId=kz8%2BYlCyRkqO5m2FOU8Kkg%3D%3D