DAte

Nov 10, 2025

Content

Reading Time

5 min

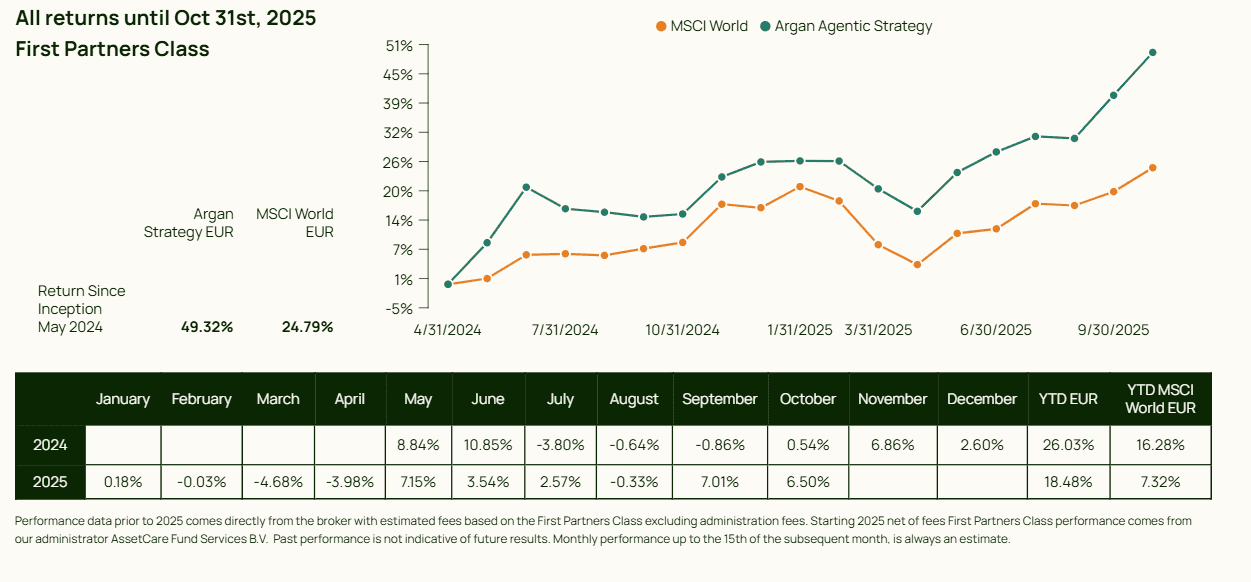

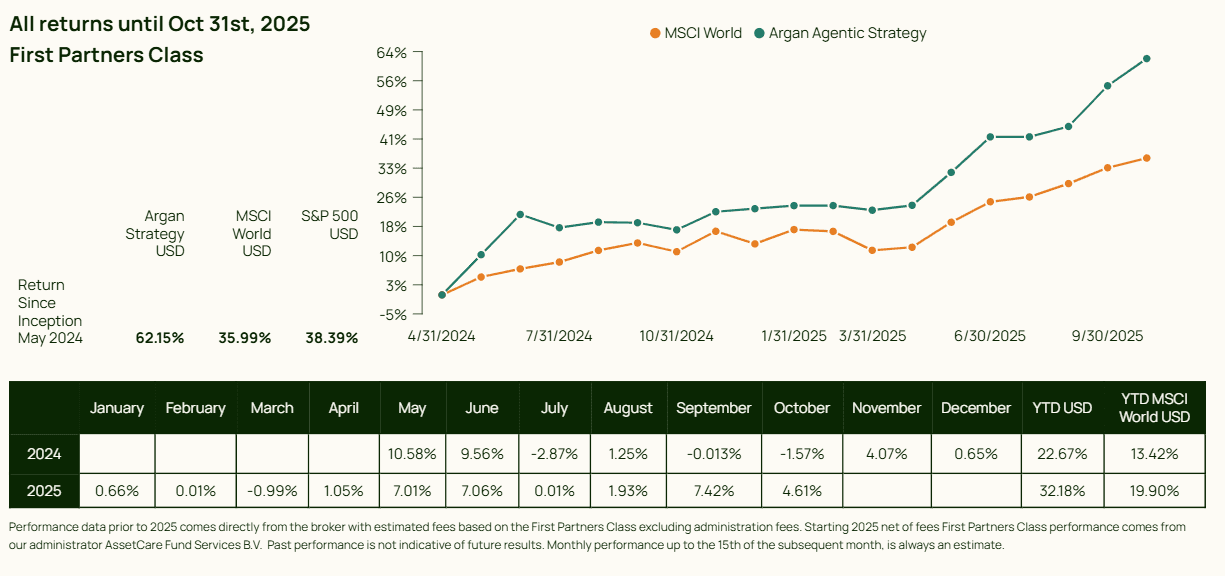

Performance (net of fees):

October added another solid month to the year. 6.50% (EUR), bringing our YtD performance to 18.48% (EUR).

Outlook:

Rather than a recap of October, let's start with what we saw last week as earnings season continued.

Tech stocks retreated even as earnings beat expectations, but could not beat valuations. The complicated thing about investing in companies is balancing projected earnings into the future with the multiple you are willing to pay for them.

You would think these two components are in harmony, but in fact they diverge significantly. And this divergence can trend upward or downward for a while. That's where the saying: “Markets can stay irrational longer than you can stay solvent” comes from. Investors then start shouting about overvaluation or, after a sustained drawdown, claiming that companies are cheap. But the point is that the two components of returns, earnings and valuations, when investing in companies have different drivers.

Recently, this valuation boom, especially in tech, has been the biggest topic of discussion. With all the capex, are we back in the 2000s telco bubble? Will AI deliver? When is the next big crash coming?

But, as I said, valuations are rarely in equilibrium. In other words, valuations are rarely correct. They either trend downward or upward away from a justifiable valuation.

The direction in which valuations move (upward or downward) is determined by a catalyst and sustained by momentum. The catalyst is macro, and momentum is the absence of a new catalyst. At the risk of oversimplifying, earnings growth has a longer cycle and is driven by fundamentals, while valuations are more volatile and driven by macro.

Taking AMD as an example, sure, the operating income from data centres was less than expected and operating margins were lower. But I say that if the last Fed meeting wasn't as hawkish, this would be less of a problem. For prices to move up, you need one of two things. Either you expect valuations to be able to go higher because of a more accommodative macro environment and liquidity, or earnings have to be so much better than expected, to justify buying more. With Chair Powell coming out guns blazing, and low visibility due to the government shutdown in the US, all markets could lean on was earnings growth. And with so much priced in, it's not a question of beating earnings but a matter of beating valuations.

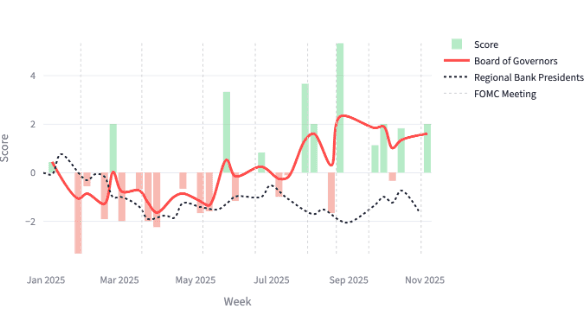

As a fun fact, this last hawkish twist from the Fed should hardly have been a surprise. Below is the output of our latest AI Fed analyst for NINA, that looks at all US central banks’ communications to forecast the view on the economy. If you look at the monetary policy stance of the various voters, there's a large divergence between the Board of Governors and the regional bank presidents on what path monetary policy should take. And that divergence is increasing.

Still, there is something to be said for caution on monetary policy amid low visibility.

We are amidst the longest and most elaborate government shutdown in the US. What started on Oct 1 over ACA subsidies and spending levels has outlasted the 2018–19 shutdown (About 700k+ federal workers are furloughed and a similar number are working without pay; key agencies are partially or fully suspended.

We do have NINA trying to fill in the gaps in data using adjacent information, which should be pretty close to a truth of some kind. And the latest ADP release hinted toward a tepid labor market. Still, I'm continuously growing more uneasy about uncollected data that is approximated backward and released later, and how it may differ from what we think now.

The point is that it’s not always the truth that affects market behavior, but whatever is perceived to be the truth.

As for the shutdown resolution, signals out of the Senate suggest we are getting very close, as the Senate broke the democratic filibuster. In the last few days betting-markets odds for a Nov 12-15 end to the shutdown have gone up to 85%.

Currently, NINA is not seeing a fundamental break or catalyst that would ignite a full-blown valuation correction. What we saw in October and early November so far are technical corrections as the market should still be in a “two-steps-forward, one-step-back mode”.

The focus should now also be shifting from how fast the Fed cuts to what it does with the balance sheet. Stopping QT sounds dovish, but changing its composition (shortening duration, shifting mix) can quietly tighten conditions. With continuous debt issuance, a rising debt-to-GDP and debt-to-liquidity ratios. Regardless of who the president is, the US central bank has to fall in line to support the government.

Targeting aggregate demand and inflation, in times of fiscal imbalance, when interest spending is larger than defense spending, is hardly down to the central banks; and monetary policy is indeed subservient to fiscal policy.

NINA looks for a break in valuations, or a persistent sell-off if you will, in these avenues. When the inflation risk premium turns out to be much higher than expected because the fiscal expansion has gone too far. Or when the liquidity pool dries up because the Fed miscalculates the demand for financing following treasury issuance. Or even a simpler policy mistake, such as a central bank thinking its interest rate policy should be run in the same way as when the debt-to-gdp ratio was below 100%. It is possible such a mistake starts with the US central bank.

In any case we are looking at either a sideways or a more negative month in November as we get more clarity.

Argan.ai:

Company updates: what’s been happening at argan.ai

We will open for external investors as per 2 January 2026.

Over the past months, we’ve seen growing interest from investors following our performance and strategy updates. If you’d like to explore potential allocations or learn more about our process, feel free to reach out.

Participants, friends, and family event at HOLLD Yachts

On December 3, we will be welcomed by HOLLD Yachts for an exclusive visit to their shipyard. If you haven’t received your invitation, reach out to us and we will share the details

New office: Atlas Arena

We recently moved into a new office with, most importantly, parking spaces and room to grow. This is very exciting, so feel free to stop by for a coffee! Our new address is: Atlas Arena, 2nd floor of the Gebouw Europa, Hoogoorddreef 11, 1101BA, Amsterdam

Contact us:

Investor relations: Martijn Mook - martijn@argan.ai - 0634229754

Office address: Atlas Arena, Gebouw Europa, Hoogoorddreef 11, 1101 BA Amsterdam

Make sure to follow us for, among others, our weekly macro update: Follow argan.ai on LinkedIn