DAte

Dec 9, 2025

Content

Reading Time

5 min

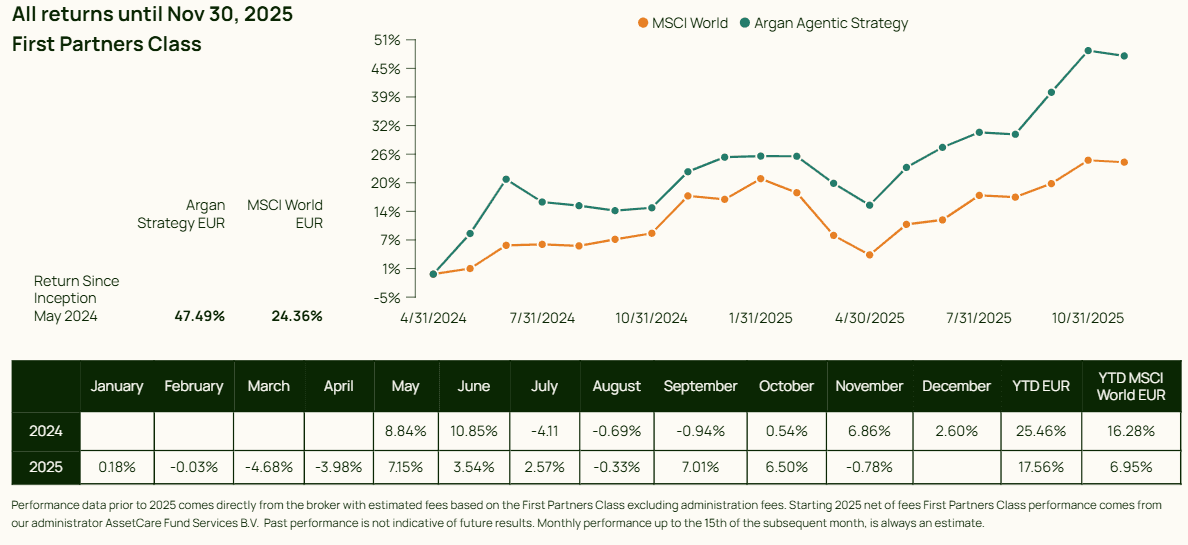

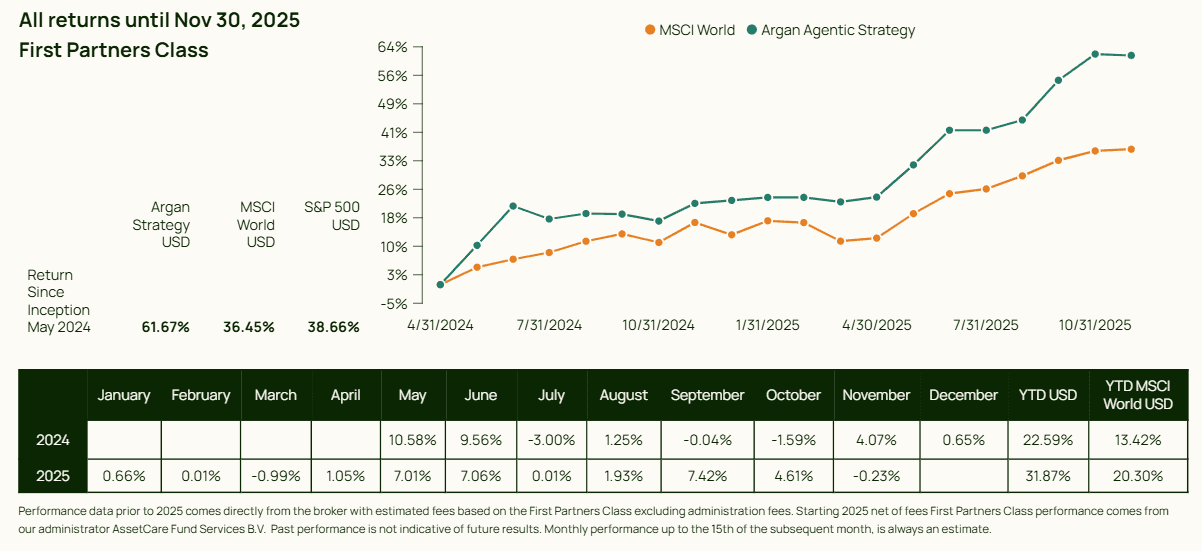

Performance (net of fees):

Last month we ended with the note that we were looking at a more negative month because of low liquidity and low visibility following the government shutdown.

As mentioned we were not looking at a fundamental break or catalyst that would ignite a full-blown valuation correction. As such, as the technical corrections ensued, we held our ground. In terms of volatility, i.e. ups and downswings in the market, while it did increase it wasn't as extreme as many pundits made it out to be.

We had over $1 trillion being wiped from crypto with sentiment indicators screaming “extreme fear”. The drawdown has moved almost in lockstep with a sell‑off in speculative tech and artificial‑intelligence names, and in some cases even led to it. A classic sign of tightening liquidity.

The mechanics and market dynamics of these “risky” assets have become increasingly similar over the years, and that convergence is central to how my system takes positions in companies. Does the macro and market backdrop support a big valuation increase (or decrease), even if it temporarily diverges from some notion of fair value?

In the end, it’s the market and its participants that set prices. November was a textbook liquidity story. Funding spreads had been spiking, and market plumbing was flashing warnings.

The speculative leg down was, in my view, less about discovering that “intrinsic value” and more about a regime shift: lack of excess liquidity and scarcer funding. In that environment, assets with cash flows or narratives far in the future are hit hardest.

As with bitcoin we said that things like AI‑related equities or early‑stage tech, one is not just making a call on innovation; but also implicitly on a long global liquidity and easy credit.

Outlook:

Going forward I think the Fed has to step in and start buying bills as there is a continuing demand for liquidity following government issuance. Simply stopping quantitative tightening (QT) and some liquidity injections here and there isn’t enough. I think the liquidity picture will be one of the key risks while entering 2026.

While the market is going into this week's Fed meeting expecting a 25 bps cut and another 50 bps in 2026, the focus is too much on the target rates and not enough on the balance sheet and inflation risk premia.

As previously said, with continuous short term debt issuance, rising debt-to-GDP and debt-to-liquidity ratios, the US central bank has to fall in line to support the government, regardless of who the president is.

As for the 2026 outlook in general, we are entering a phase I like to refer to as two-horses and many carriages. With tech and AI combined with fiscal spending carrying the economy. That can run hot until it runs too hot. While the previous monetary driven stimuli pushed asset prices up, a structural fiscal policy impulse will push prices up in the real economy.

In terms of economic growth, AI capex and ~6% of GDP fiscal deficit is going to continue to fuel the US economy. That fuel ends up in tech, datacenters and the like, leaving manufacturing, housing and small business behind. So the unevenness of the economic pockets of activity is likely to continue.

As for US Inflation, monetary and fiscal policy we have structural deficits that push the Treasury to soak up a growing share of global savings, pushing term premia up. In that sense AI is going to be one of the final avenues of increasing corporate profit margins and maybe even providing a deflationary cushion.

The Fed will likely bring policy rates lower towards around ~3%. The big balancing act is them providing relief for small businesses and housing, without over-fueling the AI/tech complex or destabilising the dollar and bond market.

For that we need contained dollar outflows, term premia and 10-year yields that don't tower above nominal GDP. Moreover, long-run inflation expectations must stay anchored. In that case deficits push up rates, equities and inflation volatility but don't push the economy towards a bear case.

As for equities, I care less about whether valuations diverge from a so-called “fair value” point and more about the direction of the trend in valuations. There certainly is a spread in fundamentals and pricing. Still US large caps, especially the AI-adjacent ones, show high free-cash-flow margins and ROIC versus history and versus non-US markets, which justifies a good part of their premium multiples.

While there is a lot of praise for small and mid cap opportunities, I believe we can expect underperformance there. Especially companies that are not beneficiaries of the fiscal push, not AI enablers/implementers, and not structurally protected from AI competition.

If the Fed does stay on this ~3% rate path over 2026, it will be a headwind for this sector of the equity market. Capital markets have become more about refinancing than providing capital, and expensive refinancing is a headwind for the smaller companies.

As for risk, I already mentioned the first one. Liquidity mistakes. A hawkish Fed that tightens into already-weak housing and small business would pull liquidity from the bottom hitting credit spreads and cyclicals, then equities more broadly.

But also AI disappointment + heavy debt financing. The one thing that worries me there is that the adoption cycle seems to be priced in on too short of a horizon. As adoption lags and IG issuance for AI keeps ramping up, spreads could widen and the narrative could flip from “productivity boom” to “telecom-style capex bust” in the short run.

And finally we have debt induced inflation combined with tariffs. Tariffs behave like a tax that raises some prices and erodes demand; sustained escalation, especially if misread by the Fed as classic inflation, would heighten the risk of policy error.

All of this means, higher interest rate inflation risk premium and interest rates volatility, a continuous path of the soft USD and US equities continuing to grow in terms of valuations. Moreover credit spreads can awaken from this place of zen like calm with High Yield spreads at 2.8% in the US, that mean you only get 2.8% compensation above the risk free rate “on average” for buying riskier bonds. Especially as issuance ramps up in the investment grade market.

Argan.ai:

Company updates: what’s been happening at argan.ai

We will open for external investors as per 2 January 2026.

Over the past months, we’ve seen growing interest from investors following our performance and strategy updates. If you’d like to explore potential allocations or learn more about our process, feel free to reach out.

Participants, friends, and family event at HOLLD Yachts

Last Wednesday, we were invited by Mo Ouass, co-founder of HOLLD Yachts. We Dutchies have a proud reputation in the yachting industry. But what HOLLD is building in Zwartsluis goes beyond tradition. These carbon-fiber catamarans are engineered for a rare blend of speed, comfort, and structural perfection, redefining what luxury performance truly means. With a large group of entrepreneurs and relations, we saw the production process in real life. Curious to see the pictures? Click here.

Listing of argan.ai on deZaak.nl

argan.ai found its way into De Zaak's 2025 overview of investment funds. De Zaak is focused on Dutch entrepreneurs, and so are we, by offering entrepreneurs an investment solution that works for them. It's a small thing to get listed, yet another sign our investment strategy, powered by AI, is steadily finding its place in the mainstream conversation.

Contact us:

Investor relations: Martijn Mook - martijn@argan.ai - 0634229754

Office address: Atlas Arena, Gebouw Europa, Hoogoorddreef 11, 1101 BA Amsterdam

Make sure to follow us for, among others, our weekly macro update: Follow argan.ai on LinkedIn