DAte

Oct 10, 2025

Content

Reading Time

5 min

In September, I had the honor of speaking on AI at a summit by With Intelligence HFM, alongside two of Europe’s largest funds. What struck me most in my discussions during the summit, was how many established players still use this powerful technology as a bonus tool: for summarizing meeting notes or supporting PM’s.

Having embedded AI analysts in the process, I must admit I understand why, the challenges are very real and it's not a puzzle easily solved. Unlike reasoning, summarization is a problem not riddled with hallucinations, stochastic results and data contamination. Still I believe it's a challenge worth tackling, hence argan.ai.

Then came the news that we are nominated as ‘Newcomer of the Year 2025’. A small line in an email, but a big moment for our team. A sign that the market is starting to recognize what makes our approach different. These moments, on stage, in meetings, and in front of my screen, make me reflect on what it means to build something new in a world that never stops evolving.

What about our performance in the month of September?

It was a classic, bad news is good news kind of month. Following the 911,000 downward revision from the preliminary benchmarking to U.S. non-farm payrolls from the BLS, risk markets were eyeing the start of a rate cutting cycle, toward the 300-325 bps Fed target rates.

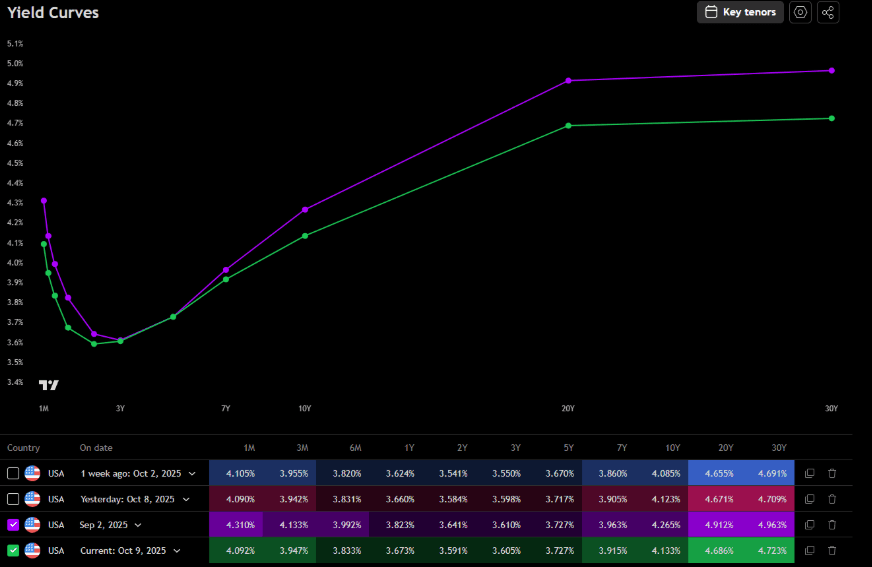

Simply put, the US labor market seemed to be weaker than expected, but not falling off a cliff, while inflation expectations remained in the “one-off-exogenous” camp. This meant that the Fed had room to cut, resulting in short term rates having plenty of room to come down. The market then extrapolated this as an expected downward trajectory of long term rates as well. This can be seen in the graph below, comparing the yield curve today with that of the 2nd of September.

Our system showed that the inflation data (CPI) started signalling price pressures in the sectors that are most exposed to Chinese trading. But, the other characteristics of the data showed positive signs in terms of trend in the overall inflation rates.

Now, lower rates alone can mean higher multiples for risk assets and lower real rates are generally good for precious metals such as gold. But I believe there's more to it. I believe we are moving more into a world of fiscal dominance, but we’ll do a series on this topic later on.

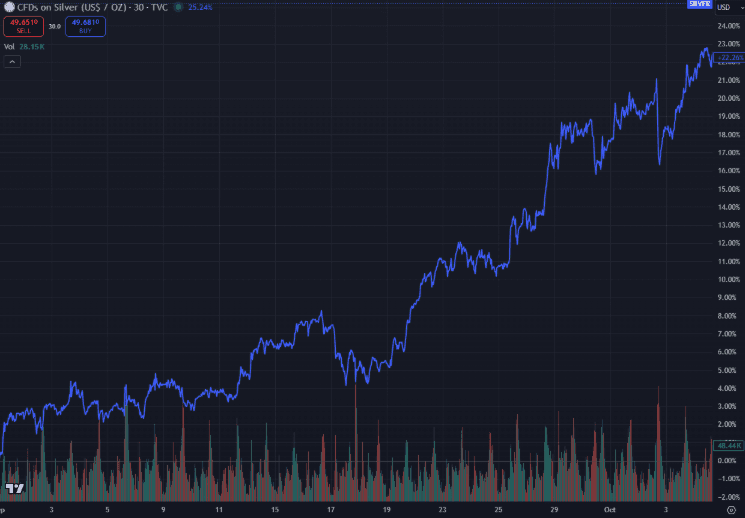

Back to gold, which increased ~14% in value since then. While we know that there is a lot of gold being bought by a select group of central banks, NINA suggests that this is not the main reason for the rise in gold prices. It is in fact the expected global policy of lower rates and more fiscal spending. As an example lets look at silver, the higher beta brother of gold, that is not being bought by those select groups of central banks, which followed the same price trajectory. Now by no means is this the main argument, but if you look at cross asset correlations over the past months it has risen significantly, suggesting a joint macro factor driving the moves. Rather than idiosyncratic buying.

Outlook:

Let's start with the fiscal picture. For now suffice it to say that the rate cuts pave the way for the U.S. administration to try to kill two birds with one stone.

That is: reduce interest rate costs and inject cash into the economy by issuing more bills. NINA’s treasury analyst flagged that the net cash raised, in August, was already historically very high, with almost 90% of that in bills. Moreover, longer bond issuance was only 6% in August, and ~16% in September. We can expect more bill issuance with lower Fed target rates, which is why the OBBBA has moved the stimulus path further down the line.

Our portfolio was positioned very much towards this trend, with high quality tech companies and gold leading the way.

A macro analyst had written on LinkedIn something along the lines of “ride the wave of optimism while spending a lot of time understanding where the possible default lines lie". That is exactly how I would summarize our outlook.

I think it's hard to forecast the actual earnings growth 10 years into the future when it comes to these transformations. The old adage: overestimate the short term and underestimate the long term comes to mind.

But you can ride the (exuberant) valuation growth, "carry play", until the party stops. And the catalyst for the party stopping, even in the dot-com bubble, usually is macro. When conditions tighten, investors start asking themselves, "wait, maybe I am paying too much for this unproven forward estimate of earnings."

And naturally those conditions will tighten at some point, it's just a matter of when and how, which we continuously monitor.

With lower labor supply from the US immigration policy and the trend in natural population growth, the risk of endogenous inflation remains. With the government shut down there is some visibility lost on the labor market, but correlated data continues to show weakness. If that weakness continues, we are looking at short term tighter conditions but longer term looser ones. For now our outlook is that the labor market is not falling off a cliff and we in fact expect looser conditions and more liquidity in the market in the short term, while the longer term conditions, budget deficit, bill issuance, curve steepening and rising term premia will make it so that the market will bite its own tail.

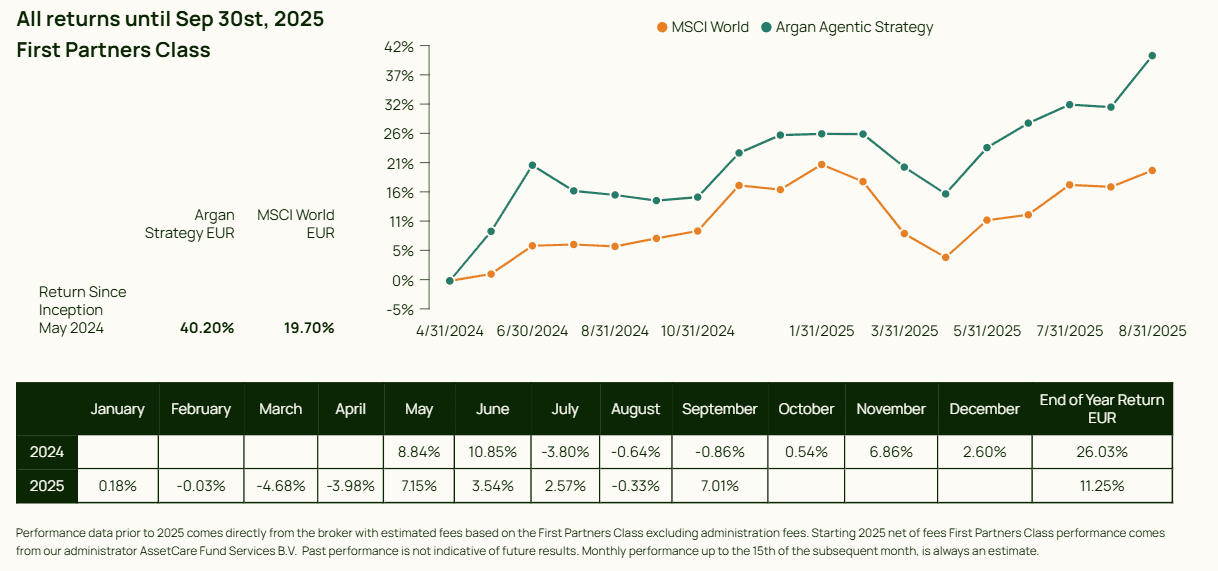

Performance (net of fees):

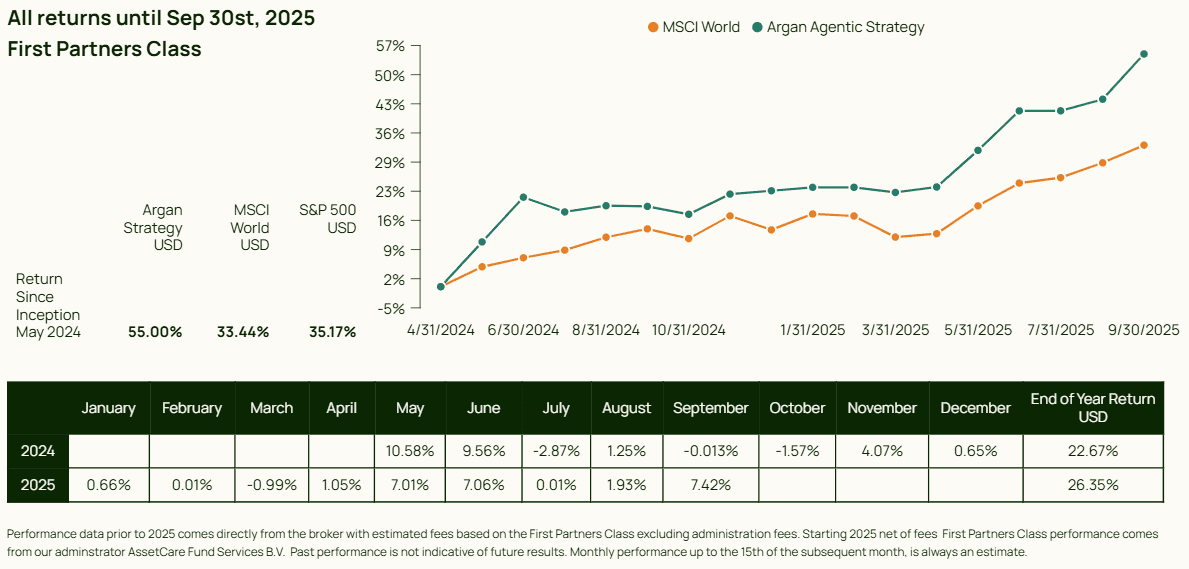

What a quarter it’s been. Volatile markets, shifting narratives, yet steady execution from our system.

July: 0.01% (USD) | 2.57% (EUR)

August: 1.93% (USD) | -0.33% (EUR)

September: 7.42% (USD) | 7.01% (EUR)

The strong September capped off a quarter that tested conviction and rewarded discipline. But as always, performance is just one snapshot, the real story unfolds over the investment horizon, where consistency and patience truly compound.

Argan.ai:

Company updates: what’s been happening at argan.ai

It’s been a busy quarter for us and for those following us on LinkedIn, you might have noticed. Full of milestones, conversations, and recognition. Here’s a quick recap.

Video series on how we use AI in our investment process:

October 8, 2025 – 🤯 Size does matter (Part 2 of our AI series)

We revealed how smaller, specialized AI models can outperform the giant ones and why fine-tuning is an art form of its own.October 1, 2025 – 🤯 Our personal headaches using AI in the investment process (Part 1)

Reza shared the early days of our AI journey and the headaches of bringing language-model logic into a non-stationary macro world.

argan.ai shortlisted ‘newcomer of the year 2025’

October 2, 2025 – 🏆 argan.ai shortlisted for the HFM European Performance Awards 2025

We’re honored to be recognized as Newcomer Equity, a proud milestone for our systematic macro-equity approach.

Reza joining Societeit Vastgoed to share how AI is used in the investment process:

September 22, 2025 – 🤖 AI panel with Sociëteit Vastgoed

Reza joined industry leaders to discuss how AI agents like NINA monitor macro trends — from interest rates to employment data — in real time.

The upcoming Dutch elections from a tax perspective:

September 21, 2025 – 🍸 Investor evening with Duijn Tax Solutions

Together with Joost de Leeuw and Duijn Tax Solutions, we hosted a lively debate on how Dutch election outcomes could reshape wealth taxation (Box 2 & 3).

Our investors share their portfolio perspectives:

August 9, 2025 – 🚀 Portfolio Perspectives with Huib Boissevain

Huib shared why he invests in argan.ai — and how replacing human analysts with AI agents can create an edge in tomorrow’s economy.

Contact us:

Investor relations: Martijn Mook - martijn@argan.ai - 0634229754

Office address: Kleine-Gartmanplantsoen 21-1, 1017RP, Amsterdam

Make sure to follow us for, among others, our weekly macro update: Follow argan.ai on LinkedIn